How to Calculate the Operational Costs Behind Your Product

Misjudging employee costs, such as hourly wages, can lead to financial losses. If a business underestimates its labor costs, it might overspend on hiring without realizing it. Knowing the true cost of an employee, including all additional expenses such as federal unemployment tax, health insurance, and office space, allows for precise budgeting. The fully loaded cost of an employee includes direct and indirect expenses such as health insurance, training, office supplies, and taxes.

Why Fully Burdened Labor Rates Matter

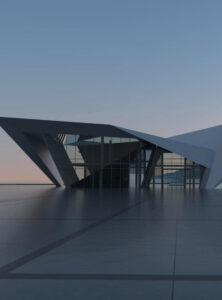

The challenge of determining the cost of building a construction project can seem like an impossible task. Considering the unique nature of each project and the fact that material and… Explore valuable insights into the latest construction trends and project management best practices, and learn how Procore’s platform can optimize your projects. About this Episode Running an agency is tough—especially when you start as a subject-matter expert fully loaded cost and suddenly find yourself as a business owner with no formal training in operations or finance.

Account

- Remote work has also pushed companies to rethink their benefits packages.

- The most common application we’ve seen has been trying to assess the profitability of projects and clients either in the scoping phase of a project or retroactively.

- This amount is withheld — you’re not actually responsible for it other than remitting.

But unless you can get an accurate representation of how much your operational costs actually are, you will never be able to find ways to lower them. Please contact us today to discuss the true hourly cost of your workforce and leverage those insights to improve your business operations. How you calculate fully loaded employee pricing is a critical part of nailing your earning efficiency, which is the foundation of your agency’s profitability.

Anything higher than 30% shows labor costs are having too great of an effect on your bottom line. Say you cover 75% of healthcare premiums and extend this coverage to dependents. You pay about $520 per month for the employee and an additional $520 a month for their spouse and two children, for a total of $2,080. Depending on the nature of your business, there could be other items on your overhead expenses report. And as your business grows, overhead costs are typically expected to do the same.

Impact of Remote Work on Fully Burdened Labor Rates

- Comparison calculators available (you may know this type of calculator as a geographic differential calculator) elsewhere to allow you to prepare bids for such situations.

- The true cost of hiring a highly skilled professional in Latin America is often lower than hiring a less experienced candidate domestically.

- Check out this excellent article on WallStreet Mojo for a more comprehensive take on this particular phase of the process.

- If a company is audited and found to have underpaid these taxes, it could face fines and back payments, which are costly and time-consuming to resolve.

- The turnover rate in companies can have a significant impact on overall expenses, as companies spend considerable resources on recruiting, training, and onboarding new employees.

- The cost of living in many Latin American countries is lower than in the United States, which translates to lower salaries for equally skilled professionals.

Many employers offer voluntary benefits to attract and retain talent, which represent substantial indirect costs. Health insurance premiums are a major component, with average annual premiums for employer-sponsored health coverage being substantial. The FUTA tax rate is typically 6% on the first $7,000 of an employee’s wages. Employers usually receive a credit for timely payments to state unemployment funds, reducing the effective federal rate in most cases. This guide helps you calculate fully loaded employee expenses for smart budgeting and business strategy.

Fully Loaded Cost of Goods definition

This can disrupt ongoing projects and delay important business activities. Knowing the detailed costs, including the base salary and additional expenses per employee, helps you allocate resources strategically. You can determine the most cost-effective way to distribute your workforce across different departments, optimizing the use of office space and minimizing unnecessary overheads.

The starting point of any compensation package is the base salary or hourly rate. Understanding the total compensation requires a detailed breakdown of its components. Each category plays a critical role in determining the total cost of employment, and overlooking any one of them can lead to inaccurate budgeting and financial shortfalls. This cost goes far beyond the employee’s wages, encompassing direct and indirect expenses that are critical to keeping operations running smoothly.

By eliminating these costs, you can redirect funds towards other critical areas of your business. Companies that fail to account for these expenses may find themselves facing unexpected financial strain, making it essential to develop a comprehensive budgeting strategy. Hiring full-time employees comes with numerous benefits, such as greater control over work quality and consistency. Employers are also responsible for withholding certain taxes from employee paychecks, such as federal income tax, state income tax, and local taxes.

Non-billable time like this will end up in our Gross Margin calculation in the accounting software when things get reconciled – although your accountant may want to call this contribution margin (that’s cool). Generally, we think about this in terms of how many hours per week we’re paying them for in a given period of time. I see this most often when questions about overhead and billable capacity come into the fold. This usually happens when someone is trying to work backward from project-costing to net-profitability. The number of human resources professionals in the company for every 100 employees. FICA taxes include 6.2% for Social Security and 1.45% for Medicare — a total of 7.65% that you are responsible for.

While in-house employees can provide stability and loyalty, outsourcing can often offer more flexibility and cost savings. These are a significant aspect of the fully loaded employee costs that cannot be overlooked. These taxes are mandated by federal and state laws and directly impact the total compensation cost. For example, employers are required to pay payroll taxes, contribute to programs like social security, and provide benefits such as health insurance plans and pension plans. Understanding the true cost of employment is essential for businesses of all sizes. For small companies, the hidden expenses of hiring can erode already tight profit margins, while for larger enterprises, failing to consider all aspects of the fully loaded salary can lead to significant inefficiencies.

You started your agency because you loved your craft—and for a while, it just worked. But things have changed since you first started in the industry, especially these last few years… Margins are tighter. Marcel is an agency profitability optimization consultant, keynote speaker and the CEO of Parakeeto. He’s on a mission to help the average agency get the information they need to be more profitable. From sharing educational content and resources to creating tools at Parakeeto to make measuring the most important metrics easier – everything he does is aimed at making agency profitability more accessible.

Using that info, you can now properly compare your true cost to what a 3PL will provide you. If you are taking your costs from the “contracted rated chart”, then you will likely be off by more than 3-7% depending on the shipping service you are using. Another commonly incorrect way to estimate shipping cost is assuming you can take an average cost of your “zone chart”, or even worse, assuming the majority of shipments all go to one “zone”. Workforce PayHub, Inc. is your local provider of Human Capital Management solutions that assist you in managing your most valuable asset, your workforce. The Workforce team currently provides expert payroll, time & attendance and HRIS solutions to more than 39 states and territories. The issue is that correcting those issues often feels like starting a figurative thousand-piece puzzle.