etl coin price 9

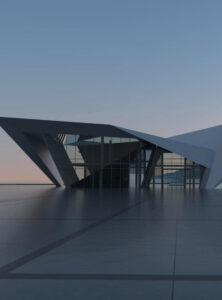

Etherlite Price Today ETL to USD, Price Index & Live Chart

Despite the ETH’s higher growth recovery, the Cardano and Solana price chart shows the formation of a well-known reversal pattern called a cup and handle. The chart configuration is typically found at a significant market bottom, and it foretells a fresh accumulation trend and long-term recovery. Apart from the impact of Bitcoin, Cardano’s increasing applications in DeFi, NFTs, and AI-driven decentralized apps may further see more attention, giving more long-term value etl coin price to ADA. Our model predicts the ADA price chasing a $4.5 peak with an average trading value of $5.82.

- If this materializes, the ETF would significantly encourage more institutions to get involved and make ADA’s market more liquid and visible in traditional financial markets.

- Ethereum Classic first set out to preserve the integrity of the existing Ethereum blockchain after a major hacking event led to the theft of 3.6 million ETH.

- Out of the N/A transactions, N/A transactions were documented as buy and N/A transactions were documented as sell.

- By the second half of 2025, the market anticipates the potential resolution of diplomatic tension between the United States and other countries.

- These collaborations are essential for providing an external layer of scrutiny, offering an additional assurance that the platform’s security measures are up to date and effective against potential threats.

MobiKwik Wallet

- The most active and popular exchanges for buying or selling ETL are Kraken, Bybit & Binance.

- It enables users to transact and interact with a broader range of cryptocurrencies, thereby enhancing liquidity and fostering a more interconnected blockchain landscape.

- One of the main differences between Ethereum Classic and Ethereum is their approach to governance.

- These technologies will power Cardano to accommodate sophisticated decentralized applications (dApps), as well as enhance the ecosystem’s DeFi offerings.

Telcoin is regulated as a Virtual Asset Service Provider in the EU (Lithuania) and Argentina, a Major Payment Institution in Singapore, and a Money Services Business in the US, Canada, and Australia. Therefore, in the next twenty-five years, the ADA coin could become a store of value rather than just a speculative investment. As this blockchain usage integrates into daily life flow, including digital citizenship, AI utility, and everyday transactions, the ADA coin could drive a high-momentum rally.

The implementation of sidechains for exchanges with other cryptocurrencies represents a significant technical advancement for Etherlite. This feature facilitates interoperability and seamless exchange between Etherlite and other digital assets, expanding the utility and reach of the Etherlite ecosystem. It enables users to transact and interact with a broader range of cryptocurrencies, thereby enhancing liquidity and fostering a more interconnected blockchain landscape. ETLLL is a decentralized financial payment network that rebuilds the traditional payment stack on the blockchain.

What are the best exchanges for buying and selling ETL?

By 2050, Cardano could be one of the foundational infrastructures powering global decentralized systems. Africa’s young and fast-growing population may provide an opportunity for Cardano to demonstrate its use case in education, finance, and supply chain management. Our analysts forecast that these advancements may considerably increase ADA’s demand pressure and trigger a rally to $12, while the sellers may drive the asset to a low of $7.1. Still, the altcoin might keep an average volume of trade of $6, and a short-term correction may force the asset to the price level of $5. In 2026, Cardano is set to have the Leios upgrade rolled out, allowing a significant throughput increase and taking TPS into tens of thousands.

Put your crypto knowledge to the test and earn cash rewards.

Trading volume of ETL (etl) in the last 24h was $N/A, which is approximately 0.00% of its current market cap. By 2030, Cardano coin shall be on conclusive growth, backed by a healthy, mature network, a strong technology backbone, and adoption worldwide. The Leios update long deployed with features such as Hydra, Mithril, and cross-blockchain interoperability through Sidechains, in effect, Cardano would be on a path to being a high-performing Layer-1 blockchain. During the first half of 2028, Cardano’s price may further appreciate with a rounding bottom setup to reach an all-time high of $3.

Bitcoin, Bitcoin Cash, Ethereum, Litecoin and other popular cryptocurrencies can be purchased with U.S. dollars using Coinbase. Once you have purchased Bitcoin using Coinbase, you can then transfer your Bitcoin to an exchange such as Binance to purchase other cryptocurrencies, including EtherLite. The current cryptocurrency Market Capitalization Dominance among all other cryptocurrencies in the market. These are the project’s quantitative metrics of its Organizational GitHub Public account that can be used to trace regular or artificial development activity & growth within the project. Availability of the crypto-assets displayed is subject to jurisdictional limitations and specific terms and conditions. Crypto.com may not offer certain crypto-assets in certain jurisdictions due to potential or actual regulatory restrictions.

There are currently 0 EtherLite coins circulating out of a max supply of 21,000,000,000. The content published on this website is not aimed to give any kind of financial, investment, trading, or any other form of advice. BitDegree.org does not endorse or suggest you to buy, sell or hold any kind of cryptocurrency. Before making financial investment decisions, do consult your financial advisor. The quantity of all coins/tokens that have ever been issued (even if the coins are locked), minus all coins/tokens that have been removed from circulation (burned). Publicly circulating amount of specific cryptocurrency coins/tokens that were mined or issued to date, and are not locked/staked (are available to be traded publicly).

Cardano offers promising potential with its staking rewards and DeFi ecosystem, but regulation and volatility pose threats. Still, the second half of 2028 may witness a post-halving correction or diminished recovery pace. Following the initial Bitcoin-spurred rally, the market typically goes into cooldown mode, rebuilding its bullish impulse before the next jump.