types of doji 1

The Complete Guide to Doji Candles in Trading

Readers are advised to conduct their own due diligence and seek independent financial advice before making any investment decisions. A market is not very strict and does not react if a few cents or points a candle closes higher or lower. And, you do not react either if there is a few cents or points variation. In general, long-legged doji means that both sides, bears, and bulls are fighting to defeat the other side. And, in this situation, both upward and downward movement is possible.

60-90% of retail investor accounts lose money when trading CFDs with the providers presented on this site. The information and videos are not investment recommendations and serve to clarify the market mechanisms. In this example, we can observe how the 20-MA has served as a resistance level, essentially preventing the price from making a bullish countermove as it fails to move above past the 20-MA.

Example 4. Doji on Non-Standard Charts

- Complete the contact form, and our team will assist you with any questions or setup needs.

- It is particularly noteworthy when followed by a strong bullish candle, as it can mark the beginning of a new uptrend.

- In trading, a Doji candle indicates a state of equilibrium between buyers and sellers.

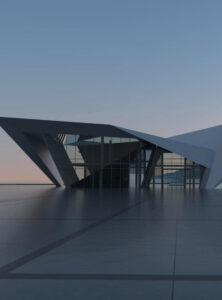

The example here depicts an initial uptrend, at the end of which a doji appears. The doji marks a point in indecision in the market where the open and close prices coincide. The two patterns that follow the doji confirm that the price reversal is imminent. As seen in the types of doji image the prices start to decline after the appearance of the doji.

- All Doji candlesticks frequently occur at market tops and bottoms or at major swing highs and lows acting as a reversal pattern.

- By incorporating these tips into their trading strategies, traders can enhance their ability to use Doji candles effectively and improve their overall trading performance.

- The second strategy involves using a simple moving average, in this case, a 20-period MA to identify the dynamic resistance level where price will likely have difficulty breaking.

- In my case, I shift from the 4-hour chart to the 1-hour chart to filter the zone and find a better entry point.

Doji Candlestick Trading Strategy

The Bullish Bears trade alerts include both day trade and swing trade alert signals. These are stocks that we post daily in our Discord for our community members. Our chat rooms will provide you with an opportunity to learn how to trade stocks, options, and futures.

Chart

However, if there are multiple four-price doji, and they fall on a small slope, it is a bullish pattern. And, if the slope is small and positive, it is a bearish pattern. A doji candle chart occurs when the opening and closing prices for a security are just about identical. If this price is close to the low it is known as a «gravestone,» close to the high a «dragonfly», and toward the middle a «long-legged» doji. The name doji comes from the Japanese word meaning «the same thing» since both the open and close are the same.